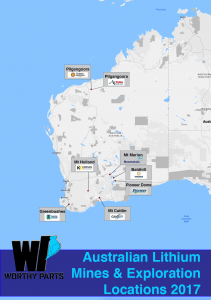

There has been lots of talk over the past twelve months regarding lithium deposits in Western Australia. Speculation is that Western Australia will become the ‘worlds lithium mining capital’! With only one mine producing and exporting lithium at the end of 2016 this seems an almost impossible statement. However only three months into 2017 there are now three lithium producing mines with a further four in development across the state.

CRITICAL METAL

What do we know about lithium? Lithium does not occur in nature in its elemental form, but compounds within hard rock deposits and salt brines. Australian hard rock miners are argued to be strategically placed compared to their Chinese and South American competitors who typically source supplies from “poorer quality brines”. Lithium is classed as a ‘critical metal’ meaning it has a number of important uses across various parts of the modern globalised economy including communication, electronic, digital, mobile and battery technologies. It’s the emerging green energy sector that places the element on the critical list. Critical metals seem likely to play an important role in the nascent green economy, particularly solar and wind power, electric vehicles and rechargeable batteries.

ELECTRIC POWERED DEMAND

The announcements that China is to build over five million energy vehicles by 2020 and that the US electric car maker Telsa received half a million orders for its Series 3 vehicle released this year suggests that there is demand for this super-charged commodity. The emerging market for home power storage units such as Telsa’s Powerwall which take households off the electricity grid are another contributing factor to see growth for the demand of Lithium. We do know that Lithium as a commodity has tripled in price since the start of 2016 for all the above reasons. Unlike most metals and chemicals there is no exchange traded market for lithium chemicals, therefore it is difficult to gauge pricing highs and falls across the industry. The negotiations of prices are set between the producers and customers, based on customer specifics, chemical make up of concentrates and the supply and demand there is and will be a disparity to establish transparent pricing trends.

GREENBUSHES LITHIUM, SOUTH WEST.

US/Chinese owned Greenbushes has officially been declared the world’s biggest lithium mine! The open pit operation has been producing lithium since the 1985 and is considered the world’s highest-grade lithium mine. Operated by Talison Lithium, Greenbushes has split ownership between China’s Tianqi Lithium with 51 percent stake and US Albemarle Corporation 49 per cent stake. There has been a recent proposal by Tianqi to develop a $400million lithium plant in Kwinana. An expected 161,000 tonnes of lithium concentrate is to be transported from Greenbushes mine to the Kwinana processing plant once completed. It is expected processing will commence at the facility within two years from when approval is granted.

MT CATTLIN, GOLDFIELDS ESPERANCE.

The recommissioned Mt Cattlin mine is located near Ravensthorpe in the Goldfields Esperance Region of Western Australia. The mine initially operated from 2009 to 2012 by General Mining Corporation. A take over of $217 million in 2016 by Galaxy Resources allowed for fresh investment for refurbishment and the restart of the existing processing plant. An estimated 10,000 tonnes of lithium concentrate was shipped from the Port of Esperance on January 2nd this year. This was its first lithium concrete shipment to China since being recommissioned. Galaxy Resources established a selling price of $1185 ($US905) per tonne this year.

MT MARION, GOLDFIELDS ESPERANCE.

Neometals first shipment from Mt Marion consisted of 15,000 tons of lithium concentrate that left the Port of Kwinana on February 6th of this year headed for China. Construction started on the mine site in 2015 with full capacity production set at 400,000 tonnes per year. Mt Marion has split ownership with China’s Ganfeng Lithium Company holding a 43.1 per cent stake, alongside ASX-listed companies Mineral Resources also at 43.1 per cent and operator Neometals holding 13.8 per cent.

PILGANGOORA LITHIUM, PILBARA.

Production is has been earmarked for late 2017 with commissioning of their $139.7 million project expected to be completed by December 2017. Altura have secured a five year take off agreement to supply 100,000 tonnes of spodumene concentrate annually to Chine’s Lionergy. Expected to be the fourth lithium producing mine in Australia, Altura are developing a ‘world class hard-rock open pit lithium mine.’

PILGANGOORA LITHIUM TANTALUM PROJECT, PILBARA.

Located in the Pilbara, Pilgangoora Lithium Tantalum Project is being developed by Pilbara Minerals and is situated 120kms south of Port Headland. Pilbara Minerals have started construction at its $214 million Pilgangoora Lithium Tantalum Project in December 2016. Mining has started this year with an agreement made with Chinese firm General Lithium. Expected to have a 36-year mine life, Pilbara Minerals first shipment is due in January 2018.

HOLLAND GOLD & LITHIUM PROJECT, WHEATBELT.

Located in the Forrestania Greenstone Belt, owner Kidman Resources have been drilling and exploring for both Gold and Lithium in tandem over a 284Km2 area. With a comprehensive drilling program at the Earl Gray lithium deposit underway, the geology of the area is comparable to the pegmatite hosting mineralization seen at Greenbushes and Pilangoora Projects. Whether the area delivers the suggested ‘Globally significant’ deposit is to be seen. There are ongoing talks in relation to an option for Kidman to lease Lake Johnston Nickel Concentrator under ownership of Poidsdon Nickel. If resolved Kidman propose to cart ore 120km from the Earl Grey deposit for processing, there will also be an estimated eight million cost to refurbish the plant for lithium processing. It is thought production from the Earl Grey lithium deposit could be worth up to $355 million annually. The only bump in the road open to dispute is if Kidman Resources can resolve the on going battle with Marindi Metals over claims it has a binding contractual agreement to acquire lithium rights at Mt. Holland. Set to go to trial at the end of May we will be hearing much more about this lithium project than most others this year!

BALD HILL TANTALUM MINE, GOLDFIELDS ESPERANCE.

A feasibility study is underway at Bald Hill Tantalum Mine situated 50 kms south-east of Kambalda. Tawana Resources are expected to complete this study by the end of March 2017. They are also completing feasibility for their Cowan Lithium Project adjacent to Bald Hill deposits. The Bald Hill Mine ownership is shared 50 per cent by Singapore’s Alliance Minerals Assets Limited (AMAL) and 50 per cent Australian Tawana Resources. The mine has existed since July 2001 however lithium was only explored as a resource when AMAL took ownership and invested in refurbishment, upgrading and recommissioning the plant in 2015.

PIONEER DOME LITHIUM-CAESIUM-TANTALUM PROJECT, GOLDFIELDS ESPERANCE.

Pioneer Resources are currently in the process of completing a Mineral Resource Estimate for the Pioneer Dome Project. Located near Norseman and 130 km south of Kalgoorlie the project comprises of seven exploration licenses over an area of 300 km². Pioneer resources are also undergoing exploration for lithium in various locations across Western Australia, the Donelly Lithium Project near Greenbushes and the Phillips River Lithium Project near Mt. Cattlin.